pay indiana business taxes online

Registering a Business Internal Revenue Service IRS Indiana Department of Revenue DOR 2. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business.

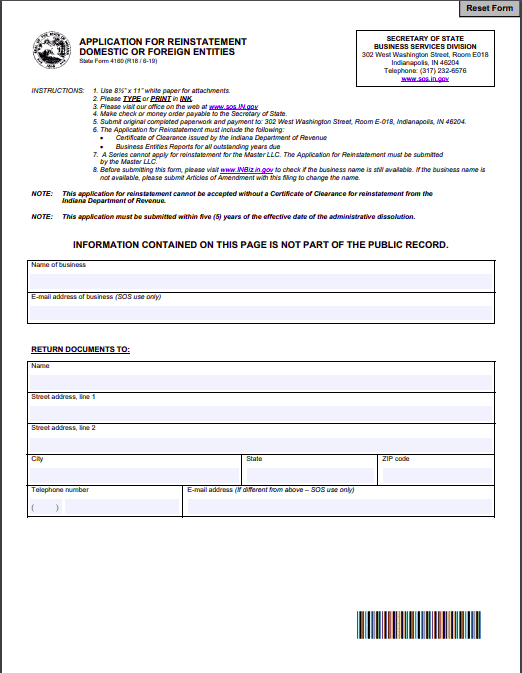

Free Guide To Reinstate Or Revive An Indiana Limited Liability Company

After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business.

. Department of Administration - Procurement Division. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales. Find Indiana tax forms.

Your browser appears to have cookies disabled. Cookies are required to use this site. Overview of Tax Types 3.

INTIME provides access to manage and pay. Here are some examples of filings available to update your business information. Articles of Amendment - used to change information such as business name number of shares.

To prevent payments from being returned bounced employers paying by e-check should notify their banking institution that electronic payments. SBAgovs Business Licenses and Permits Search Tool. Home Taxes and Fees.

Prepare to file and pay your Indiana business taxes. You can file and pay with the Indiana DOR online using the Indiana Taxpayer Information Management Engine INTIME. All businesses in Indiana must file and pay their sales and.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. County Rates Available Online. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

A payment can be made without logging in and using a Letter ID on the bill or voucher by going to the Payments panel clicking on Make a payment and then using the Bill Payment panel. Indiana businesses have to pay taxes at the state and federal levels. Indiana county resident and nonresident income tax rates are available via Department Notice 1.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portalINTIME provides access to manage and pay. Indiana Business Taxes Agenda 1. Your business may be required to file information returns to report.

If the business cannot locate. Register for INtax. INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business. The self-employment tax is a social security and Medicare tax for individuals who work for themselves. Electronic Payment debit block information.

If a business does not pay its tax liability the RRMC will expire. Indiana Small Business Development Center. Know when I will receive my tax refund.

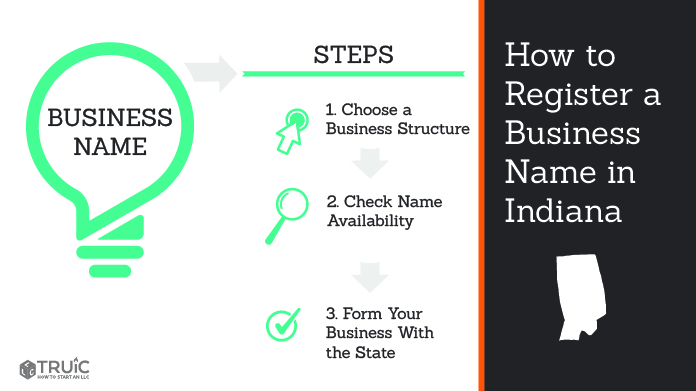

How To Register A Business Name In Indiana Truic

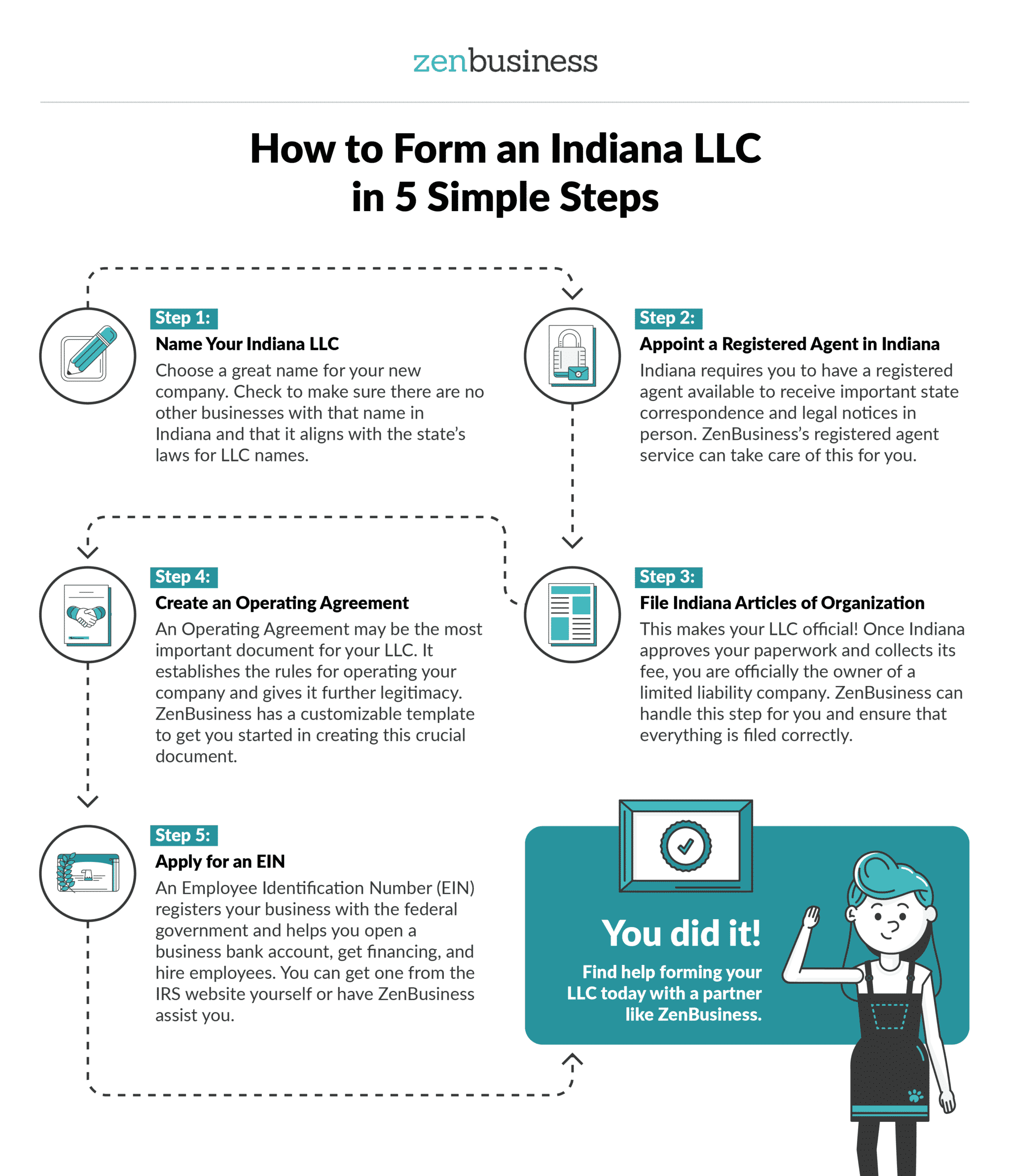

How To Start An Llc In Indiana For 49 In Llc Application Zenbusiness Inc

Indiana Annual Report Filing File Online Today Zenbusiness Inc

Dor Unemployment Compensation State Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

How To Start An Llc In Indiana For 49 In Llc Application Zenbusiness Inc

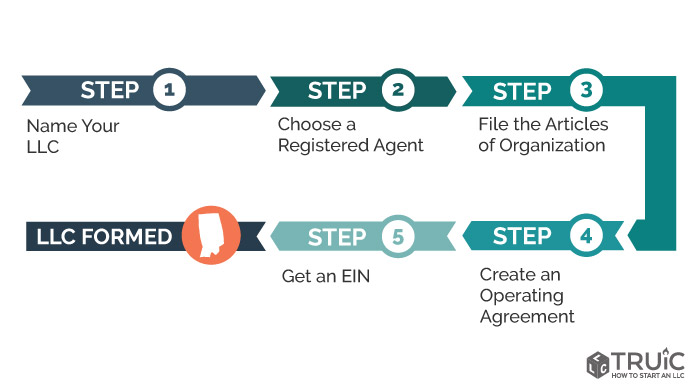

Llc Indiana How To Start An Llc In Indiana Truic

Dor Indiana Department Of Revenue

Llc Indiana How To Start An Llc In Indiana Truic

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Business Personal Property Tax How To Maximize Your Efficiency

Quarterly Tax Calculator Calculate Estimated Taxes

Oops Here S What To Do If You Missed The Tax Deadline

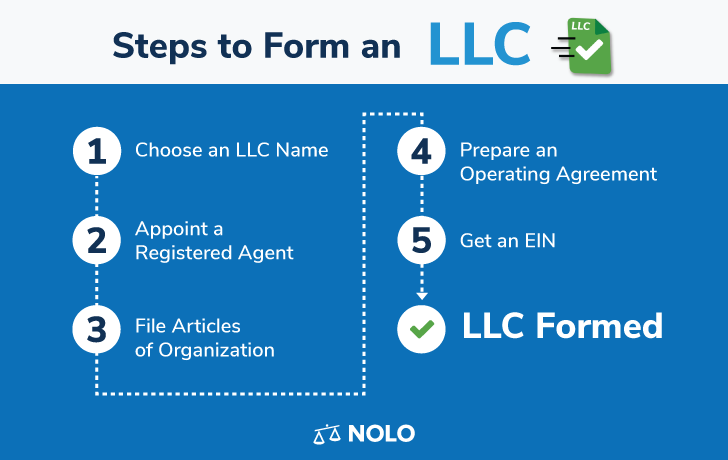

Llc In Indiana How To Start An Llc In Indiana Nolo